Our Process

Our approach to investing recognizes the unique needs of each client. Before making recommendations, we take the time to thoroughly understand your long-term goals and tolerance for risk.

Client Communication

We are firmly committed to keeping you informed and involved in the wealth management process. Organization and simplification is a top priority.

Our Process

Our approach to investing recognizes the unique needs of each client. Before making recommendations, we take the time to thoroughly understand your long-term goals and tolerance for risk.

STEP 1: We start by listening

Everyone’s financial situation is unique, so we work closely with you from the beginning to clearly define your goals and objectives. We learn as much about you as we can in order to create a tailored investment strategy for you.

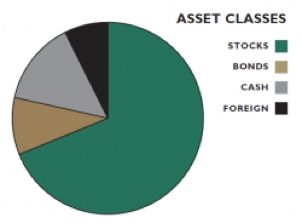

STEP 2: We develop an asset allocation

The guiding principle of our investment philosophy is asset allocation. Academic studies conducted over the last twenty years have shown that the asset allocation decision is the most important variable in determining the long-term return from a portfolio of securities. The percentage of your dollars invested in stocks, bonds, real estate and cash will far outweigh the effects of individual security selection and market timing.

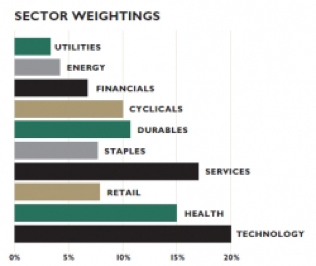

STEP 3: Investment selection and diversification

Once your asset allocation is determined, we develop a customized portfolio designed to both enhance returns and control risk. This is accomplished by selecting the best investments in each category while diversifying your portfolio among investment styles and industry sectors.

STEP 4: We monitor, manage and rebalance your portfolio

Our portfolio managers continuously monitor and manage your investment portfolio. If a necessary change is identified, your portfolio manager will make the appropriate adjustments. As new money is deposited into your account, your portfolio is reviewed to ensure the deposit is properly allocated. Since asset allocation is not a one-time event, we also periodically rebalance your portfolio. We also realize that the after-tax rate of return is your greatest concern, so. our portfolio managers and CPAs work hard to minimize taxes in your portfolio.

Client Communication

We are firmly committed to keeping you informed and involved in the wealth management process.

Dedicated Service Teams

We pride ourselves on excellent client service. We ensure service teams remain stable and focused on your priorities. Both a portfolio manager and a client service specialist are assigned to your account, ensuring someone is always available to answer your questions. Your portfolio manager manages and monitors your investments, while your client service specialist ensures a smooth and easy transfer of your assets and handles all of your administrative needs.

Quarterly Calls

You can expect a phone call from your portfolio manager at least once every ninety days. Even if no changes are necessary, your manager will call to check in and give you an update. If market conditions or your particular situation dictate, you will be contacted more frequently. You are also free to contact your portfolio manager at any time.

Performance Reports

To enable you to easily track your investments, we provide quarterly performance reports that summarize on one concise page how each investment performed during the quarter. In addition, we can produce customized reports to provide you with transaction history, deposit history and cost basis information.

Monthly Statements

Your custodian mails monthly statements directly to your home or business.

Want to set long-term goals?

Discover how Financial Planning can change your future.